Interest cost deductibility saves tax, lessens borrowing costs

Interest cost deductibility is one of the factors considered in making a decision as to whether to gear an investment. Gearing is a popular strategy used by many Australians to improve their wealth. Popular investment assets acquired in a geared portfolio include rental property (residential, commercial, industrial etc), shares and managed funds.

The cost of borrowing for an asset/ portfolio that is income producing, is significantly less than borrowing for personal (non-income producing) acquisitions: see our article ‘Bad debt made good’.

Gearing is a popular cog in the wheels of wealth creation.

Where you have geared investments for income producing purposes, the interest paid on the associated loans will need to be collated for the preparation of your annual return to the ATO. It is important that care be taken in calculating this cost.

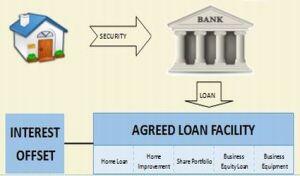

To make this process more efficient, where a single asset secures multiple loans, it is useful to have borrowings segregated in such a way as to be able to allocate each portion of the borrowing costs to a unique project/ investment. This is particularly the case where loans for personal use are secured against the same asset.

Segregating the loans achieves the following benefits –

- Your interest expense is readily able to be allocated to the project to which it relates; and

- There is less risk that the interest cost deductibility will be challenged by the Taxation Office (on the basis of the loan purpose having been ‘blended’).

How will interest cost deductibility be effected?

Loans terms that facilitate redraw are a particular concern in this regard. Under this facility, borrowers can make deposits to their loan to reduce the overall borrowing and then redraw against the reduced debt for subsequent needs. This process gives rise to the risk that –

- There is a blurring of which part of the loan has been repaid (and/ or what portion of the interest beyond the next redraw is tax deductible); and

- When a redraw for personal use purposes is made the ATO could form a different view from you as to what the relevant portions are (and Case Law appears to be on the side of the Commissioner in this situation). These loans are treated as blended loans.

Whilst managing the overall loan cost using a single loan may be financially efficient, the risk that the interest cost deductibility for tax purposes is diluted, may prove a financially disadvantage.

(If you are unable to segment the borrowings into unique accounts, and you are using a redraw facility, it would be better to arrange an interest-offset deposit account to operate alongside the loan account: this may prove to be a less financially efficient process, but should minimise the risk of the tax deduction being compromised.)

Consider the following scenarios:

Scenario 1: A segmented loan scenario –

In this scenario depicted in the adjacent image, as repayments are made they would be paid off the home loan and home improvement loan as first priority. If further funds are subsequently required, they would be drawn against an appropriately designated separate account. This strategy will have no dilution effect on the interest cost deductibility of interest attributable to income-producing purposes.

Using this structure, non-deductible (bad) interest is reduced first and the deductible interest retained whilst the loan is being paid down – until the personal-use borrowings have been completely repaid.

Importantly, the precise amount of interest attributable to each income producing project is readily identifiable.

Scenario 2a: A lump-sum loan with redraw facility –

Where all of the borrowing limit available on the security is drawn into a single loan and the disbursed for both personal-use and for income producing purposes, extreme care has to be taken when calculating the interest that is attributable to each project. This is especially so where committed repayments are being made: under the normal terms of such a loan, the lender will not segregate the interest costs against the uses to which you put the borrowed funds – and the Taxation Office are likely to apportion repayments according to the initial use proportions for the first year, revising the proportions annually to the residual balances.

This process becomes more complicated if/ when there is a redraw against any capital repayments that have been made; and particularly where the redraw has been for personal-use purposes, which has the effect of eroding the interest deduction available against income-produced by the relevant borrowed funds. (The Taxation Office has led argument that none of the interest on such accounts is allowable as a deduction because of the blending of the loan amounts.)

Scenario 2b: A lump-sum loan with a linked interest-offset account –

This scenario should produce a more acceptable outcome than that achieved through scenario 2, particularly if any drawdown is only made from the Interest Offset account as opposed to paying down the loan, then redrawing and risking the contamination of the loan amounts, risking dilution of the tax deductible interest.

Careful monitoring under this scenario leaves cash funds readily available and facilitates a discretion to repay any personal (non-income-producing) debt that attracts that ‘bad’ interest cost. See the following extract from the ATO page but note that the comment equally applies to any interest to be claimed against income earned as is shown by our inclusion of the bracketed words:

“If you have a loan account that has a fluctuating balance due to a variety of deposits and withdrawals and is used for both private purposes and rental property (income-producing) expenses, you must keep accurate records to enable you to calculate the interest that applies to the rental property (income-producing) portion of the loan. You must separate the interest that relates to the rental property (income-producing) from any interest that relates to the private use of the fund.”

The ATO has posted a series of videos on its website explaining various aspects relating to rental property taxation matters: the one under the heading “Claiming mortgage and interest expenses for your rental property” is of particular interest in this article – and is only three minutes viewing time.

How can Continuum Financial Planners be of assistance to you?

Our experienced team of advisers is available to help you with all aspects of your financial planning, from structuring your investment portfolio, introducing you to brokers/ lenders for funding investments, formulating investment strategy, caring for your superannuation, personal risk insurance needs and estate planning – ‘we listen, we understand and we have solutions’.

To arrange to meet with one of our team for an introductory appointment at no cost to you (and no obligation implied), please call our office (on 07-34213456) or use the Contact Us facility on our website.

[Originally published in May 2015, this article is occasionally updated, most recently in December 2020.]