The following article was posted in October 2008, during the severe days of the GFC aftermath – and before ‘the Storm debacle’ became publicly exposed. Continuum Financial Planners Pty Ltd has a consistent history of providing exceptional, proactive service to their ‘active’ 1 clients. The article is being updated in a minor way and re-publicised to reassure our clients that their best interest is uppermost in our business culture.

Ongoing Adviser Servicing valued by Margin Loan borrowers.

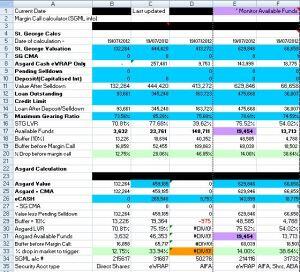

Ongoing adviser servicing valued by clients comes in all forms: for Margin Loan borrowers in the aftermath of the GFC, the servicing has been intense – and consistent. Since July (2008), Continuum Financial Planners Pty Ltd (ContinuumFP) has been updating calculations on a spreadsheet that we have designed under guidance from our primary loan provider: St George Margin Lending (SGML). >>Update note: this activity persisted until the share markets recovery was clearly under way, in late 2009.<

We have taken this course of action in an endeavour to protect as many as possible of our clients with margin loans, from receiving an unwelcome ‘margin call’ with very short notice to settle. The need has been occasioned by the extreme volatility in the equities and other investment markets.

This process, including the consequential follow-up, takes between three and six ‘man-hours’ every day (depending on the number of clients with whom follow-up action is required).

ContinuumFP staff members (advisers and their support team) are pleased to be in a position to be of service to these clients during this time of need – and in a few cases, duress. We undertake the task, looking to preserve the wealth of our clients, keeping their portfolios in tact if at all possible. We see it as ‘part of the service’ – but do look forward to a time in the near future when all will (again be) calm (restored) to relative normality!

Examples of how this work we are doing in this situation is helping clients, include the following:

- By requesting the client make a $50,000 payment into his margin loan account, a Margin Call in excess of $180,000 was averted;

- By negotiating with the SGML team we have been able to avert a near-$30,000 Call by transferring some previously unpledged equities to the Loan account; and

- A $5,000 ‘averting payment’, forestalled a $19,000 Margin Call.

In each of these cases, the client would have been forced to sell down managed funds and/ or direct shares at the worst timing in the market. Having made these provisions, their portfolios are able to continue in-tact until the next significant move in the financial markets. (An unfortunate side-effect of this process is that we have on occasions had to request additional deposits more than once from these clients.)

We trust that all of our clients will understand that our service standard in some areas is being impacted by this additional workload, but accept that our philosophy is to be as proactive as possible – and that when their time of need arises, we should also be there for them.

In spite of all of this, we are available to accept new clients – and if you are in a position to make a referral to us, that would be appreciated; and appropriately acknowledged. If you have any questions, concerns or comments about this matter, please call or email and we will attend as promptly as possible. [Update comment: the experienced advisers at ContinuumFP currently have capacity to accept new clients. If you, or anybody you know, would like to explore the opportunity to engage with our – ‘we listen, we understand; and we have solutions’ philosophy, please call 07-34213456 or complete the Contact Us form on our website and we’ll contact you promptly to arrange a meeting.]